Connecting SMEs to the

Right Trade Finance — Fast.

Whether you are importing solar panels or exporting cashews, Trade-Match.io matches you with trusted lenders who actually say yes.

No paperwork headaches. Just smart matching and trusted partners.

Validated by SMEs, Freight Forwarders, and Trade Finance Experts | Built with real feedback from ecosystem players across the trade value chain

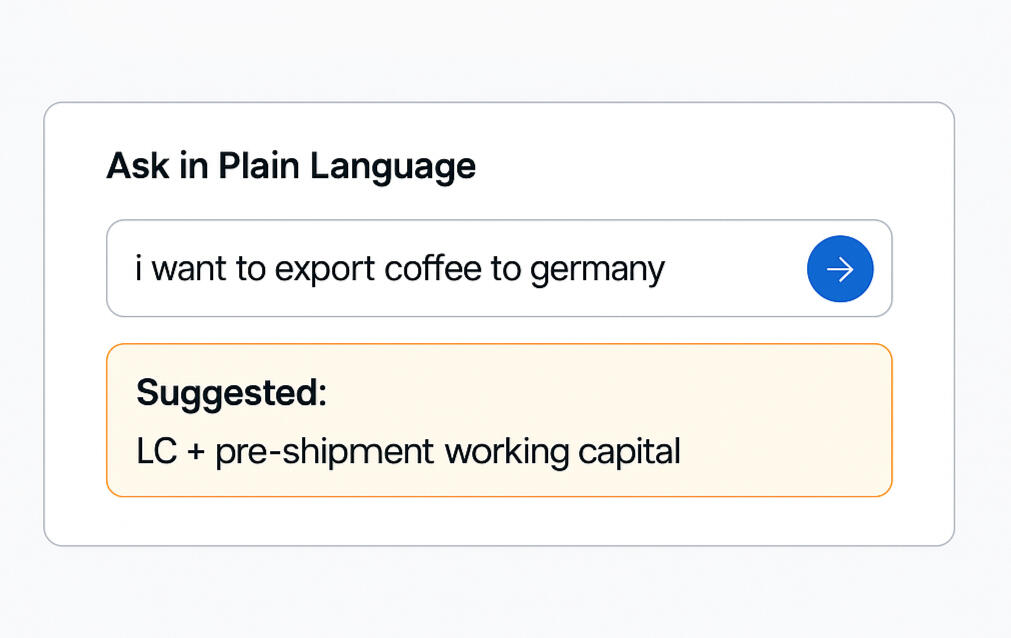

Tell us your goal

Start by telling us what you want to export, import, or finance — and our logic engine figures out what you may need.

Don’t know the difference between invoice discounting and a bank guarantee? Just ask.

Apply directly

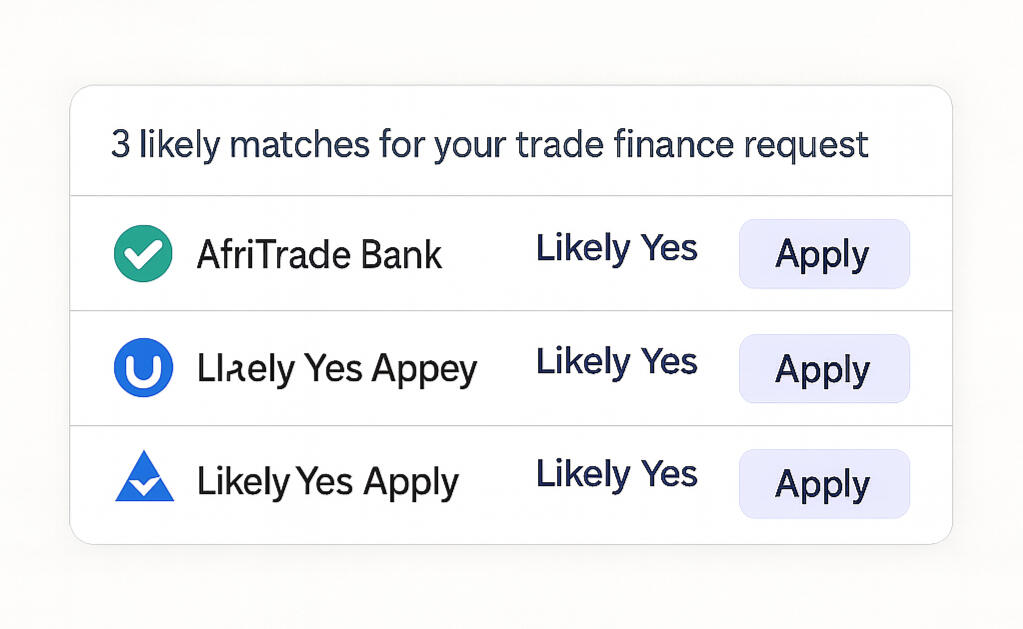

Get matched to 1–3 likely yes financial providers and other relevant trade ecosystem enablers

(not just a list).

Apply in parallel, get faster feedback, and move your deal forward — hassle free.

Join our community if you are

A registered SME in Africa, already exportng or ready to export/ import or just need capital to engage in trade or an understandng of the trade finance ecosystem.

Why SMEs choose Trade-Match.io

Because time kills deals

You shouldn’t lose an opportunity just because a funder took too long to respond. We speed up access, so you move faster.

Because trade finance is confusing

No more Googling what a bank guarantee is. We break it down in plain English, so you know exactly what to ask for.

Because trust is everything

We only match you with credible, vetted providers. No hidden fees, no shady lenders.

Because you are ready to grow

Whether you’re scaling exports or securing critical imports, we’re here to unlock the finance that fuels your next move.

Why Trade-Match.io

At Trade-Match.io, we understand that no two export journeys are the same. Whether you're shipping agricultural goods, textiles, or machinery, your financing needs are unique. That’s why we don’t offer one-size-fits-all solutions.We match you to tailored trade finance options — backed by banks, DFIs, fintechs, and specialist lenders — based on your export goal, eligibility, and context.Our platform brings together diverse capital providers, global reach, and local insight - so you can secure funding that fits your trade needs, not the other way around.We’re building a future where every viable SME - not just the well-established few - can access the finance needed to reach global markets. Because real trade growth starts with real access.

Did you know 70% of African SMEs are rejected for trade finance?

That’s why Trade-Match.io exists: to connect export-ready SMEs with the funders most likely to say yes.

*We only show your data to providers you choose to engage with.

Why We Are Building Trade-Match.io

Still deciding? Let’s help you take the next step.

You're Not the Problem. The System Is.

Export-ready African SMEs are being held back by outdated financing rules. We’re here to fix that.

100,000

African SMEs export without access to finance.

US$120B

Trade finance gap locking out SMEs across Africa.

US$650B

Export value – but most SMEs still go unfunded.

70%

Trade finance rejection rates.

Trusted. Needed. Built to Scale.

SMEs

Q: What is Trade-Match.io?

A digital platform that connects African SMEs to trade finance providers — including banks, fintechs, DFIs, and alternative lenders.Q: Who is this platform for?*

Export-ready SMEs across Africa who need help accessing trade finance solutions.Q: Do I pay to use Trade-Match.io?

No. There’s no fee to sign up or submit your info. We’re currently onboarding SMEs to help shape the platform.Q: Will I get funding directly from Trade-Match.io?

No. We are not a lender. We help match you with potential providers based on your trade finance needs and eligibility.Q: What happens after I fill out the form?

We’ll review your information and reach out with next steps. This could include a provider match or follow-up questions.

Providers

Q: What kind of providers can join Trade-Match.io?

We welcome commercial banks, DFIs, fintech lenders, export credit insurers, freight forwarders, and even individual trade finance specialists. If you provide funding, support, or logistics for cross-border trade — there’s a place for you.Q: What’s in it for me as a provider?*

You gain pre-qualified deal flow from SMEs actively seeking trade finance. You also get visibility into applications that match your criteria — saving your teams time and boosting conversion.Q: Do I pay to use Trade-Match.io?

No. There’s no fee to sign up or submit your info. We’re currently onboarding SMEs to help shape the platform.Q: Do I have to commit funds upfront or integrate with your platform?

No. You can start with zero tech integration. Just set your eligibility criteria, and we’ll send qualified leads to you. Integration becomes an option later — only if it makes sense for both sides.Q: How do you vet the SMEs before sending them to me?

We screen applicants based on key eligibility indicators — like annual turnover, trade activity, instrument type, and KYC status. You’ll only see leads aligned to your preferences.

Trade-Match.io - Democratising access to trade finance across Africa.

————————————————————

© 2025 Trade-Match.io. All rights reserved.

Privacy Policy | Terms of Use

————————————————————